A volatile market can be difficult to navigate. Large swings in the market, such as what we experienced in the first half of 2022, can often cause investors to feel anxious and even downright scared. These emotions can sometimes cause investors to react and make emotional decisions instead of logistical decisions, which could potentially have a negative impact on their long-term financial outcome.

Emotional decision-making is at the core of the study behind behavioral finance, which seeks to understand why people sometimes make financial decisions that don’t seem rational or logistical. In the following article, we’ll be exploring behavioral finance concepts and how to help protect ourselves from letting our emotions can get in the way of smart decision-making.

Understanding Market Cycles

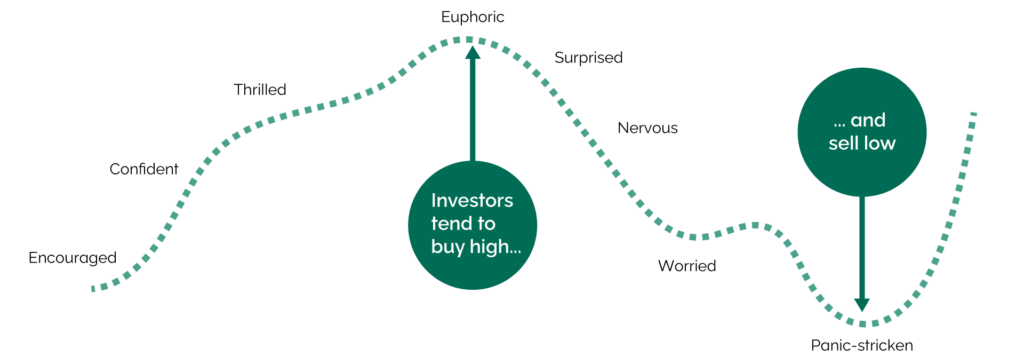

It’s important to understand that as markets go up and down, it’s natural to have strong emotional feelings along the way. The following graph illustrates common feelings that often arise through normal economic cycles.

At the beginning of an economic cycle, investors are encouraged, thrilled, and eventually euphoric at seeing increasing market prices and tend to be eager to buy during those times. When the market turns and prices drop, investors become nervous, worried, and sometimes even panic-stricken. This unfortunately is often a time when the average investor decides to sell.

Our rational minds know we shouldn’t buy high and sell low yet many investors choose to do so. This is an example of our emotional biases getting in the way of our logistical decision-making.

Common Investor Biases

The most common biases investors face include:

- Overconfidence bias: Believing that good investment outcomes are the result of skill, while undesirable results are caused by bad luck. For example, overconfidence in investing skills can lead someone to believe they can more accurately time the market than others. Overconfident investors often trade more often as a result, potentially leading to sub-par performance.

- Herd behavior: Herd behavior happens when investors follow others rather than make their own decisions based on data and research. People tend to follow the crowd because it feels “safer”. There’s also the “fear of missing out”: If your friends are making money investing in a particular stock, it can feel uncomfortable to sit on the sidelines. Herding can cause an investor to buy into investments that may not be appropriate for their financial situation.

- Anchoring bias: This is where an investor “anchors” on a certain price level—such as the price the investor bought it or the price the investor first saw. This may cause the investor to hold the stock for longer than they should as they are not taking changing conditions into consideration.

- Loss aversion: The tendency to prioritize the avoidance of a loss over opportunities to seek a gain. Loss aversion can cause us to avoid small risks that perhaps should be considered in certain circumstances. It’s a reason people choose to save rather than invest, even when inflation may erode the value of their savings — while many investments, when held for a long enough time, could potentially generate a higher return.

Our decision-making is naturally influenced by our emotions and a number of biases, which can in turn lead to errors in our decision-making. Being aware of them can help you avoid them.

How to Overcome your Biases

Start by crafting a long-term financial plan that incorporates your short- and long-term goals as well as an investment strategy that aligns your time horizon and risk tolerance to each goal. Once you have your financial plan in place, stick to it—make your decisions on your own or with the help of a trusted financial advisor. Don’t let your financial decision-making be driven by your emotions or what you read in the media or hear from friends. Stay the course.

Partnering with a Trusted Financial Advisor

One of the most important roles of an advisor is to help their clients make healthy financial decisions throughout life’s changes and to stay on track with their investment strategy, even when it’s difficult.

An advisor can help you craft a long-term financial plan and investment strategy that is unique to your family’s situation and goals and will be there for you when times get tough.

Grinnell Wealth Management has experienced advisors that are ready to help you. You can contact our team using the form below to get started.

CONTACT OUR BUSINESS WEALTH MANAGEMENT TEAM TODAY!

You are advised to not include sensitive or confidential information (i.e. Social Security #, account #’s or pass code ID information etc.) within any “unencrypted” email communication. Please be advised that contact forms are received during normal business hours. If you have not received a response within 48 hours, please call us at 641-260-2496.

Security services offered Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, a Registered Investment Advisor. Grinnell State Bank d/b/a Grinnell Investor Center d/b/a Grinnell Wealth Management and Cambridge are not affiliated. The information provided above is not means to constitute an investment recommendation for, or advice to, any specific person. Investment products are not FDIC insured, not bank guaranteed, and may lose value.